If you are actively making transactions daily, you’ll discover that the traditional bank network has been bad since FG decided to take the old naira notes out of circulation. To make transactions, you have to try and try. In short, the Bank network is terrible these days, but OPay has simply proven to be the best so far for now.

If you ask me, I’ll tell you OPay is two steps faster than your regular banking. Opay will tell you when they are having a downtime; Opay tells you when other banks are having a downtime. This easily lets you know not to attempt transferring to those banks. Not just that but OPay pays interest on your balance daily.

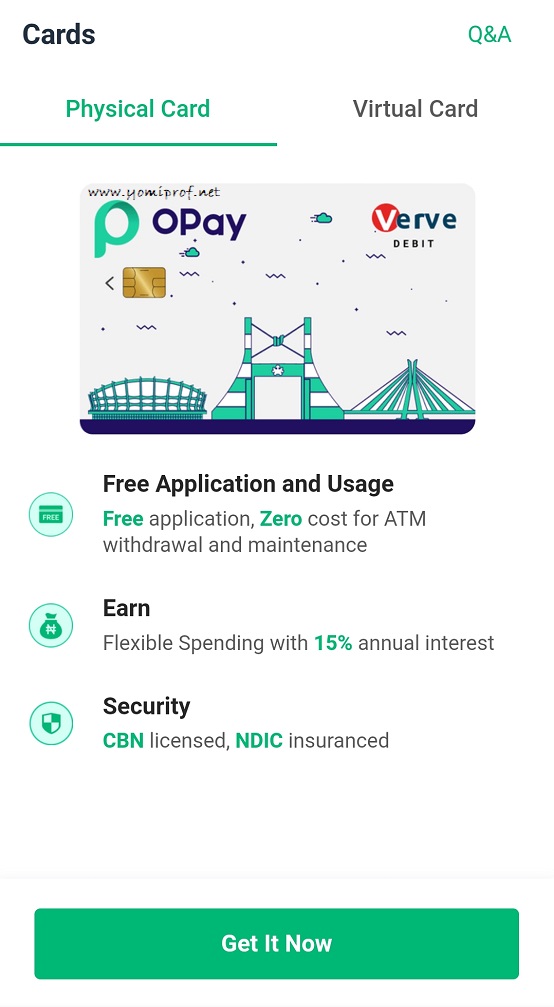

If you are an OPay customer, have you gotten your OPay debit card? If your answer is YES, welcome to the monthly cashback geng, and if your answer is NO, you are welcome to log in to the OPay app now to apply for yours.

With an Opay debit card, you can enjoy zero ATM withdrawal fees and zero card maintenance fees. Also, potential users can apply for the card without BVN and receive it within 1 minute at OPay agent locations nationwide.

How to Apply for OPay Debit Card

==>Login to your OPay app

==>Click on Card. Two operations will be presented to you. Opay Physical Card and Virtual Card. Apply for a Debit card.

Fill in your pieces of information, and correct address. Click on Apply. Your card will be delivered within the shortest period. You can activate it on any ATM closest to you, and begin using it immediately after activation.

Let us know your experience so far with OPay in the comment.

Na only verve den get that’s why I no apply. But come to think of the investing on opay am kinda afraid my money will lost just like M.M.M. and please tell me how do I get information about a bank downtime on opay?

I cannot get the money transferred from owealth to opay balance #11000. Thanks.

Yusuf,

Ikotun,Lagos.

No, you can move your funds from Owealth to the normal Opay account

you don’t need bvn to have a card?