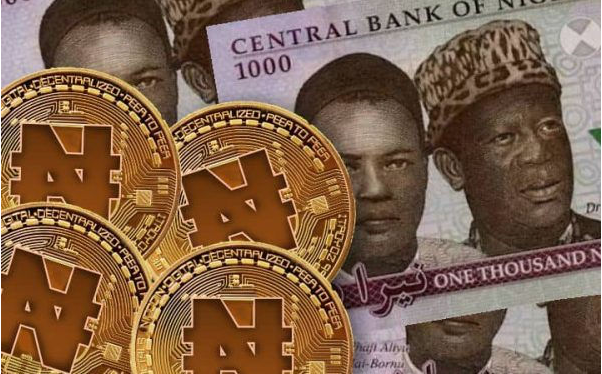

Sometimes last month, Nigeria government announced that it will launch its own crytocurrency, and now the guidelines has been announced. This is everything you need to know about Nigeria e-naira with wallet name speed wallet.

1. The Nigeria digital currency (e-Naira) will be regulated, designed, and issued.

2. The Central Bank Digital Currency (CBDC) will be launched October 1st

3. The e-Naira will be accessible to both bank account and non-account holders

4. The CBN is now on course to launch a wallet for its digital currency. This wallet enables the CBN to meet its goal of launching the e-naira by October 1, 2021.

5. The wallet, which is also known as the Speed Wallet, will have three tiers. The tier 1 wallet is open to anyone without a bank account. It also comes with a transfer limit of ₦50,000 and a cumulative balance of ₦300,000 fixed daily.

6. The minimum requirement to open this tier 1 wallet is National Identity card (NIN)

7. For tier 2 wallets users, an existing bank account with a linked bank verification number (BVN) is the minimum requirement for this level. Users are restricted to sending and receiving ₦200,000 daily and having a balance of ₦500,000.

8. Tier 3 wallet holders can transact up to ₦1,000,000 daily with the cumulative balance set at ₦5,000,000. At least a BVN is needed to get this wallet category.

9. Transaction limits on merchant-level wallets are also set at ₦1,000,000 per day, though there are no limits to how much users can have in their accounts.

10. The digital currency infrastructure does not charge for user-to-merchant transactions and P2P wallet transactions.

Finally, after the launch, Nigerian banks can invite all their customers to register for the e-Naira, with necessary validation and verification processes.

Me put my hard earned money there..

😀😀