It is no longer news that Opera market share has continued to fall in the area of browser dominance, and as a result, has created different loan app to meet up with target according to Hindenburg Research.

The report has that as a result of Google Chrome dominance, Opera decided to create predatory short-term lending apps in Africa and Asia across: OKash and OPesa in Kenya, CashBean in India, and OPay in Nigeria.

These short term loan has been charging an excessively high-interest rate. The apps would claim to offer a maximum annual percentage rate (APR) of 33 percent or less, but the actual rates were much higher, climbing to 438 percent in the case of OPesa.

And while they publicly offered reasonable loan terms of 91 to 365 days, the real length was no more than 29 days (for OKash) and more often 15 days — well under Google’s 60-day minimum.

OKash has been accused of offering high-interest rate, claims to offer 90 days repayment but in reality, it is just 15 – 29 days.

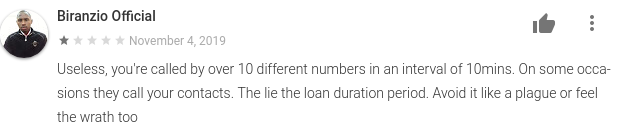

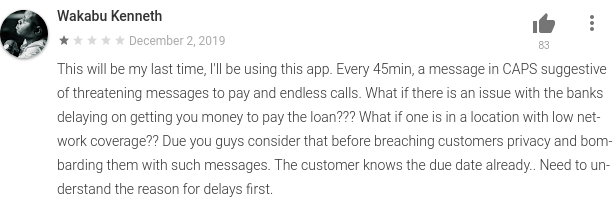

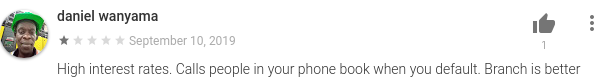

The review of Okash on Google plays store says it all

Unfortunately for Opera, scamming low-income people isn’t helping the company’s financial situation. Since the release of this report on January 16th, Opera’s stock price has dropped few hours later.

However, Opera has responded and claims the report contains too many numerous errors, unsubstantiated statements, and misleading conclusions and interpretations regarding the business of and events relating to the Company.

We want to hear from those of you that has received loan from Okash before, where you threatened, how is the interest rate?

Source: Hindenburg Research

Very true

Those accusations are true. I have personally taken loan from Okash thinking it was going to be 61 days instead I got 15 days. The interest isn’t encouraging but manageable. but the duration is mad. I defaulted in paying after collecting the 2nd time. Boy, see calls upon calls…soon I know they’ll start threatening and calling my contacts too.

this is totally bad, calling your contacts is completely wrong