Nigerian e-commerce company, Konga has launched a new Unstructured Supplementary Service Data (USSD) feature to ease transactions and a tool that allows cardless ATM withdrawals for its customers.

The e-commerce platform made the announcement via its twitter handle @shopKonga, noting that the development was to ease payment gateway and other forms of transactions.

With the cardless withdrawal initiative, customers can now cashout without the use of ATM cards, make payment on the KongaPay platform and save up time.

The new features are available on Konga’s secure payment platform, KongaPay, which is licensed by the Central Bank of Nigeria (CBN). The platform also offers peer to peer transfers, subscription payment for DStv, purchase of digital goods and airtime at discounted rates.

The new cardless initiative would allow account holders to withdraw cash from any Automated Teller Machine (ATM) nationwide, without a debit card.

Do you know you can perform your KongaPay transactions via USSD?

Pay using any mobile phone by simply dialing the USSD code (*574#) and selecting your preferred service.👉 https://t.co/GFejmvKMB7#KongaPay#Smile#Swift#dstv#gotv#glo#Mtn#Airtel#9mobile#USSD#Tuesday pic.twitter.com/anqwu8kQfE— KongaPay (@KongaPay) December 10, 2019

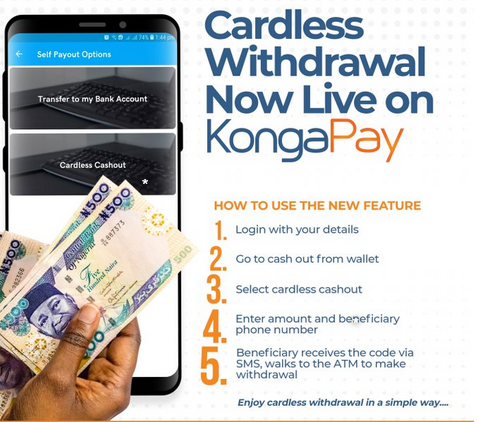

How to Make Cardless Withdrawal

1. First of all, sign up on Kongapay.com and ensure that your KongaPay wallet is funded using any of the funding options

2. To cash out, users can click on the cardless cash-out feature, enter their mobile number or that of the person they wish to send money to.

3. The person you are sending money doesn’t necessarily have to be registered on KongaPay Wallet. To complete the transaction, the user will have to input their personal identification numbers (PINs) and One Time Password (OTP) to complete the transaction.

4. The cash sent can then be withdrawn from any ATM using the cardless withdrawal or pay code cash-out feature. By inputting the 8 to 14-digit withdrawal code, earlier sent via SMS, and inputting the cash out PIN sent via SMS, the recipient can collect cash instantly.

Nice initiative… This makes the ease of doing business great

Good development

Many establishment are using this method oooo

Have make use of AccessBank careless withdrawal for some few times, and the service is not free AccessBank charge 100 naira per transaction on ATM, and the highest amount at a time is 20000.

So I believe it will not be free of charge too