Lots of people have been asking if this option is available

online instead of passing through the normal micro-finance banks with neck

breaking requirements. The good news is that it is available online and you can

get in less than 24hours.

online instead of passing through the normal micro-finance banks with neck

breaking requirements. The good news is that it is available online and you can

get in less than 24hours.

There are times that you are just pinned to the wall and you

need a narrow escape out of it but your bank account is reading “red”, in such

a situation, getting a loan might be your only option.

need a narrow escape out of it but your bank account is reading “red”, in such

a situation, getting a loan might be your only option.

Paylater® is a simple, entirely online lending platform that

provides short-term loans to help cover unexpected expenses or urgent cash

needs. No collateral, guarantors or

application fees required. Just a few clicks of a button.

provides short-term loans to help cover unexpected expenses or urgent cash

needs. No collateral, guarantors or

application fees required. Just a few clicks of a button.

Paylater is a service provided by One Finance & Investments Limited

(RC No: 1044655), a licensed Finance company.

(RC No: 1044655), a licensed Finance company.

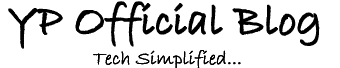

Interest is charged at

a daily rate of 1% which means that if you borrow ₦10,000 you’ll have to

pay back ₦11,500, in 15 days, or ₦13,000 in 30 days.

a daily rate of 1% which means that if you borrow ₦10,000 you’ll have to

pay back ₦11,500, in 15 days, or ₦13,000 in 30 days.

How does this work?

For first timers, the maximum range is N10,000 after which Paylater

expects a total of N11,500 in 15 days or N13,000 in 30 days. There are really

no hassles involved in this as they simply debit the said amount from your bank

account on the due date.

expects a total of N11,500 in 15 days or N13,000 in 30 days. There are really

no hassles involved in this as they simply debit the said amount from your bank

account on the due date.

For the application process, Paylater has made it easy

for applicants as they all have to go through their Facebook accounts (which

already has details of each person) to login.

for applicants as they all have to go through their Facebook accounts (which

already has details of each person) to login.

They currently offer two loan packages:

PAYLATER (loans available to all)

& PAYLATER PLUS (loans for salary earners).

& PAYLATER PLUS (loans for salary earners).

Requirements

>>Android Phone

>>Real Facebook Account

>>BVN

Why BVN?

The BVN provides all the verification details the company needs

before they can give out loans. It “verify that the individual applying for a

Paylater loan is the same as the owner of the provided bank account.”

before they can give out loans. It “verify that the individual applying for a

Paylater loan is the same as the owner of the provided bank account.”

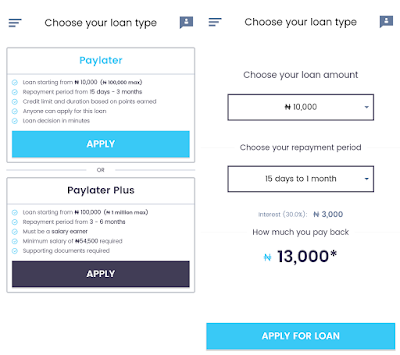

How Do I Payback my Loan?

On the due date, Paylater.ng automatically debits

your account by the amount you owe, if you are not comfortable with that,

you can pay manually.

your account by the amount you owe, if you are not comfortable with that,

you can pay manually.

Once you log into your dashboard, you will see the current loan

you have applied for and you will also see the PAY NOW button.

Click on it and the page below would come up.

you have applied for and you will also see the PAY NOW button.

Click on it and the page below would come up.

Enter your credit card details appropriately and click OK once

you are done.

you are done.

How Can I Apply For a Loan?

It’s simple! Just follow the steps below to apply for a Paylater

loan:

loan:

2. Register your personal details

3. Choose your desired loan amount and duration

4. Submit your application. You will get a loan decision

in seconds.

in seconds.

5. If approved, your account is credited within

30 minutes.

30 minutes.

You can chat them up on twitter here

I know a lot of people who have benefited from this

platform and I’m sure many will still benefit from it too.

platform and I’m sure many will still benefit from it too.

Have you borrowed money using

Paylater? Please share your experience in the comments section below.

Paylater? Please share your experience in the comments section below.

Isn't this opposite of MMM?,and they say MMM can't pay 1% but a micro finance can take 1% daily as interest on loan.Okay o

Isn't this opposite of MMM?,and they say MMM can't pay 1% but a micro finance can take 1% daily as interest on loan.Okay o

ha oga yomi…even in freetown nothing is free this this is compound interest not simple interest if u did maths very well u go know sey micro finance loan and did one na identical twins

Lol! I don't think so

Have been trying to get loan from them but am finding it difficult to summit my loan form because of location. There trying to get my location but keep on failing maybe is the phone am using I don't no. Am using Techno Y4.

Did you enabled location from ur settings? You need to allow it. Try it again and make sure your internet connection is stable.

Lol.. I ave died.. Every way Na way Money must be made.. see new ponzi scheme. i beg

Pay later isnt a ponzi scheme v know them for a long time

Nigerians will still abuse it

To borrow 10k ?

May God almighty save this country

Sori for digressin. Pls, i need solution on Bluetooth switching on automatically overnight on my new gionee phone . Though am suspecting it could be as a result of turning on d location . Cos, location at times can access Bluetooth . Just confused. Any help, prof yomi

Currently using their service.

I have been using it for long now, They are real and awesome

PaYlater is a life saver.nice app

Been using this since last year, helps out when u need urgent small cash. Why do Nigerian have the spirit of negativity when something new comes out. This is no ponzi scheme, if u have not tried out something and knkw it's drawbacks first hand don't condemn it pls . The service works try it if u need it.

The service works perfectly cos I have used it several times when I need urgent cash….as for the doubting Thomases pls don't be so quick to tag every financial platform as a ponzi scheme……theu give loans to make money do you expect them to collect back the exact money they loaned out? You know that ain't possible

Been using this since last year, helps out when u need urgent small cash. Why do Nigerian have the spirit of negativity when something new comes out. This is no ponzi scheme, if u have not tried out something and knkw it's drawbacks first hand don't condemn it pls . The service works try it if u need it.

Hope they will not be removing my money now that they have access to my Bvn

I`m confusing because of the BVN required

I've collected the loan before. They won't deduct your money until the due date and that's if money is in your money in your account. Note :you need have 100 in your bank account to protect your card online.

In addition,you will have to pay the money back

Be careful of the people u are referring. Someone who I referred couldn't payback because of some problem, and it also effected me. They stopped giving me loans, and it took me long time to understand the real reason. Thank God the guy has finally paid.

What if you refuse to pay back, what will happen?

Oga Yomi tell us na we are all ears

Acording to the guy, they called him. They also told him that he can't travel outside country till he paid. They system will automatically deduct the money whenever any money entered ur account. But if u want to borrow upto 50k they will ask for ur picture and ID card number. I don't know what will happen if u refuse to pay whe6u borrow upto 50k and above . Maybe they will trace u with the ID card.

Yeah, for real, what if you can't pay back under 30 days?

They will call u. And they will deduct it whenever any money entered ur account. And according to them, u can't travel outside country.

Nigerians go like this one ehen

I know someone whose loan is 2 months overdue and all they have been doing is sending him messages, recently they threatened to involve the police.

Nigerians nawa. If people continue like that then they will kill their system. To get loans from normal banks is not a day job.

Threatening with police???

U must be joking

Great innovation…

I feel loans and slavery are synonymous. The difference is that the latter shouldn't even exist as a word.

haven't tried it before.

The interest rate though. Local bams are still the best bet with low interest rate.

Exactly. Which bam you dey for Mkd? I wan join one too.

Not interested in this.

Not for me.

But good for those interested

I haven't tried d service of Paylater but it's a good idea from the inventor

I dnt just like dis paylater for anything….dem dey chop people head like mad…

I have used them TWICE, they are okay.

I have been using online loan platforms for a while now. paylater is good but have a very hostile customer service when u don't pay on time. I also use Quickcheck dey are reliable too and friendly customer service.

They removed the money my friend owe them from his account

This article might need an update – there's a lot of things that are no longer correct about the service.

– all first-timers no longer start at 10k by default. The app calculates a loan offer and presents varying offers to different individuals based on their financial status. Interest rates are also not 1% daily for everyone.

– a Facebook account is no longer required to register. Just phone number and email.

– there's no longer a 'Paylater Plus' package – all loans go through the offer calculation process mentioned above.

Tried using their service last year but the app keeps messing up. Maybe I'll reconsider them.

This platform is very risky. Why would they have direct access to one's account for deduction and what if something goes wrong maybe mistakenly with their system just don't trust them enough.